Developed by:

Benefits

We’ve cracked the code.

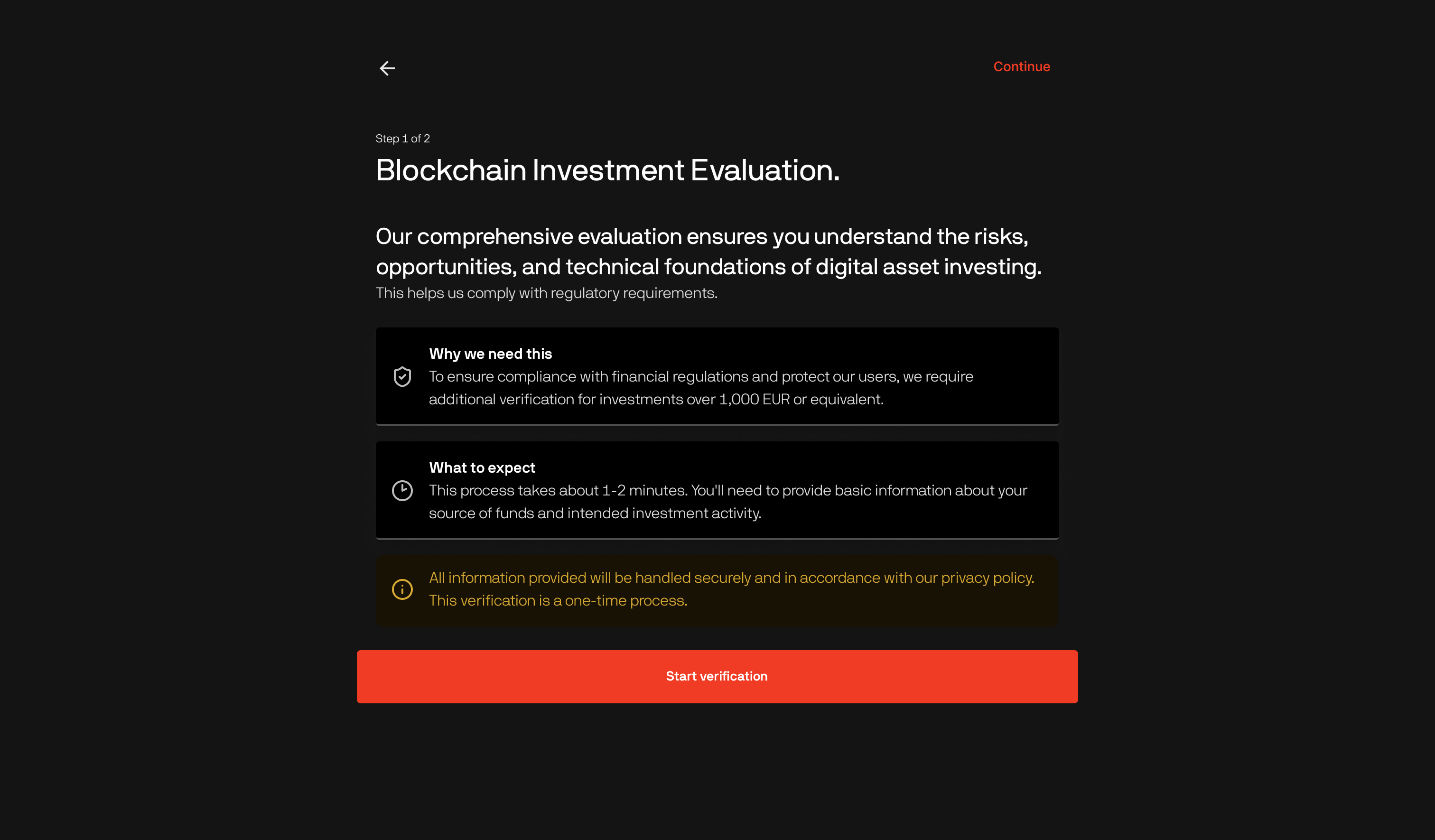

As regulatory frameworks evolve, informed investors need proven blockchain literacy. Our comprehensive evaluation ensures you understand the risks, opportunities, and technical foundations of digital asset investing.

01

Passing Criteria

Score 9 out of 10 questions correctly overall, AND achieve 100% accuracy on all "Investor Objectives and Risk Tolerance" questions. No exceptions.

02

Attempt Limits

Maximum 3 attempts within any 30-day period. Plan carefully and study thoroughly before each attempt.

03

Certification Benefits

Successful candidates gain eligibility for participation in compliant token offerings during the pilot program lifetime.

04

Investment Limits

Self-certified income and net worth verification required. Maximum 10% investment of greater annual income or net wealth per offering.

Broad assessment

14 Critical Knowledge Domains

Master these essential topics to navigate the blockchain ecosystem safely and effectively

Discover More

Key ManagementPrivate keys, seed phrases, wallet security fundamentals

WalletsCustodial vs non-custodial, hardware vs hot wallets

Market Risk and Volatility24/7 trading, price swings, correlation risks

StablecoinsBacking mechanisms, depegging risks, reserve audits

Smart Contract RisksAudit limitations, upgradeable contracts, oracle manipulation

Loss of FundsIrreversible transactions, address errors, network mistakes

Decentralized Finance (DeFi)Impermanent loss, composability risks, high APY reality

Liquidity and Trading RisksVesting schedules, exchange listings, slippage

Token Sale RisksPre-sale failures, price discovery, liquidity promises

Governance RisksVoting power concentration, proposal manipulation, flash loan attacks

Blockchains and BridgesL1/L2 differences, cross-chain risks, bridging mechanisms

Phishing and Social EngineeringFake websites, wallet connections, social media scams

Token IdentificationContract addresses, fake tokens, verification methods

Token ValuationsSupply dynamics, utility value, market cap analysis

“Capital formation is at the heart of the SEC's mission, yet for too long the SEC ignored market demands for choice and disincentivized crypto-based capital raising. As a result, crypto markets pivoted away from offering crypto assets and deprived investors of the opportunity to use this technology to contribute to productive economic enterprises”

Paul Atkins

SEC Chair

July 31, 2025

90%

10

03

Connect with us

Our evaluation framework anticipates regulatory developments, ensuring participants understand both current risks and emerging compliance requirements as the U.S. establishes itself as the global leader in blockchain innovation.

Learn More